dSoc Crypto Newsletter #2 — Stablecoins and the Curve Protocol

Overview:

Welcome to the second issue of the newsletter! In this issue I will go over stablecoins, a core component of the cryptocurrency landscape, by discussing the uses of stablecoins, as well as how they are able to maintain peg. A peg in this scenario, simply means that the token maintains its price. For DeFi of the week, I will talk about the Curve.Fi protocol, and why it is a core component of DeFi much like AAVE.

As always, if you already know how stablecoins work feel free to skip to the DeFi of the week where I talk about the Curve.Fi protocol!

Stablecoins - What are they?

Stablecoins are a core component of cryptocurrency. They are tokens pegged to the value of 1 USD, and are not affected by the volatile nature of the cryptocurrency market. This allows users to use the token as a stable store of value, which is non speculative and zero risk. Furthermore, it allows stablecoins to be utilised as a medium of exchange between assets.

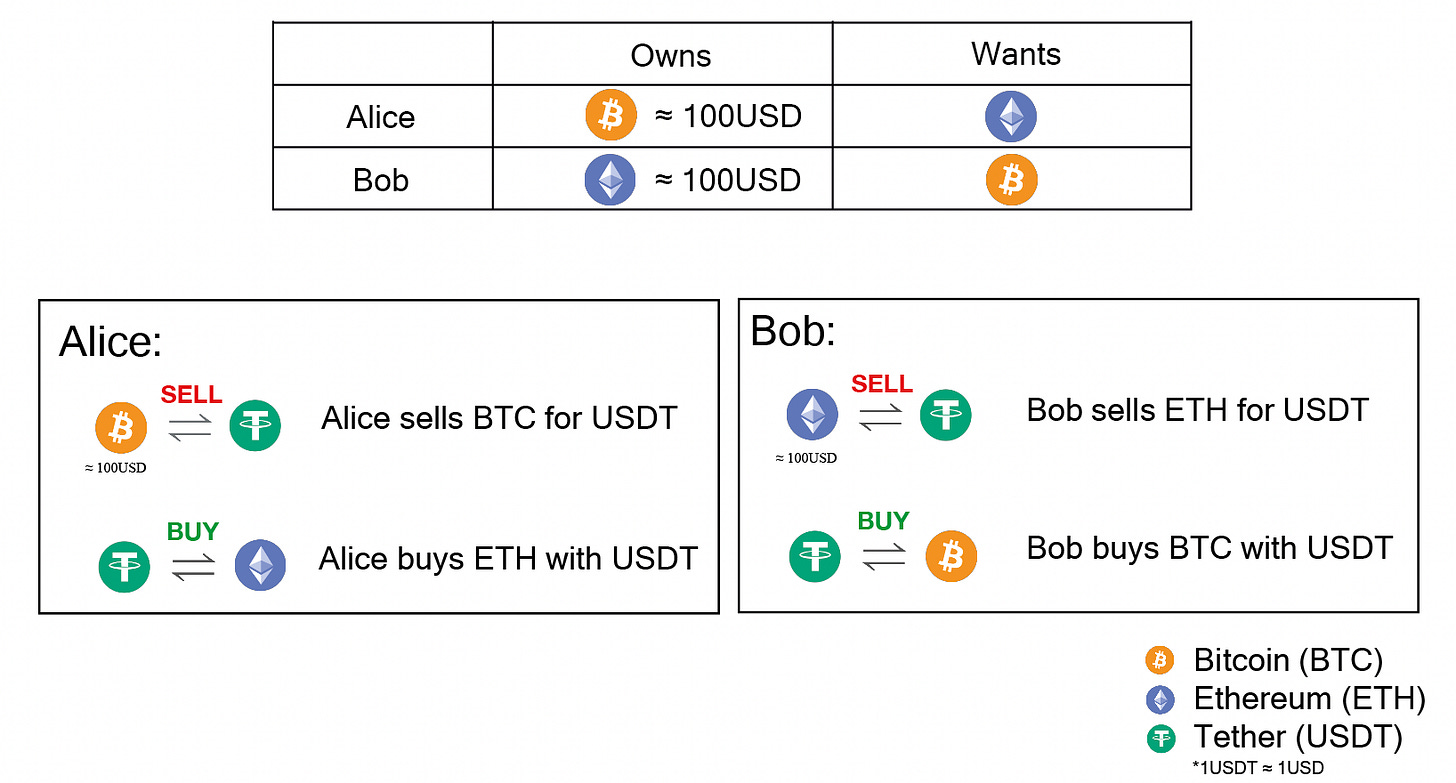

Take this example:

Alice has $100 worth of Bitcoin, and wants Ethereum

Bob has $100 worth of Ethereum, and wants Bitcoin

Unfortunately, there is no way for Alice to directly sell BTC to Bob for ETH (There are, but we’ll assume this is the case for the sake of argument).

By using USDT, Alice could sell her BTC into USDT, then use that USDT to purchase ETH from Bob. In the same way, Bob could sell his ETH into USDT, and then use that USDT to purchase BTC from Alice.

As you can see, stablecoins allow the cryptocurrency industry to run smoothly and eases the barrier of transaction between parties.

So how do stablecoins maintain peg?

The key properties of a stablecoin is it’s peg to the USD. Therefore it is crucial that the peg is maintained no matter what the market conditions are.

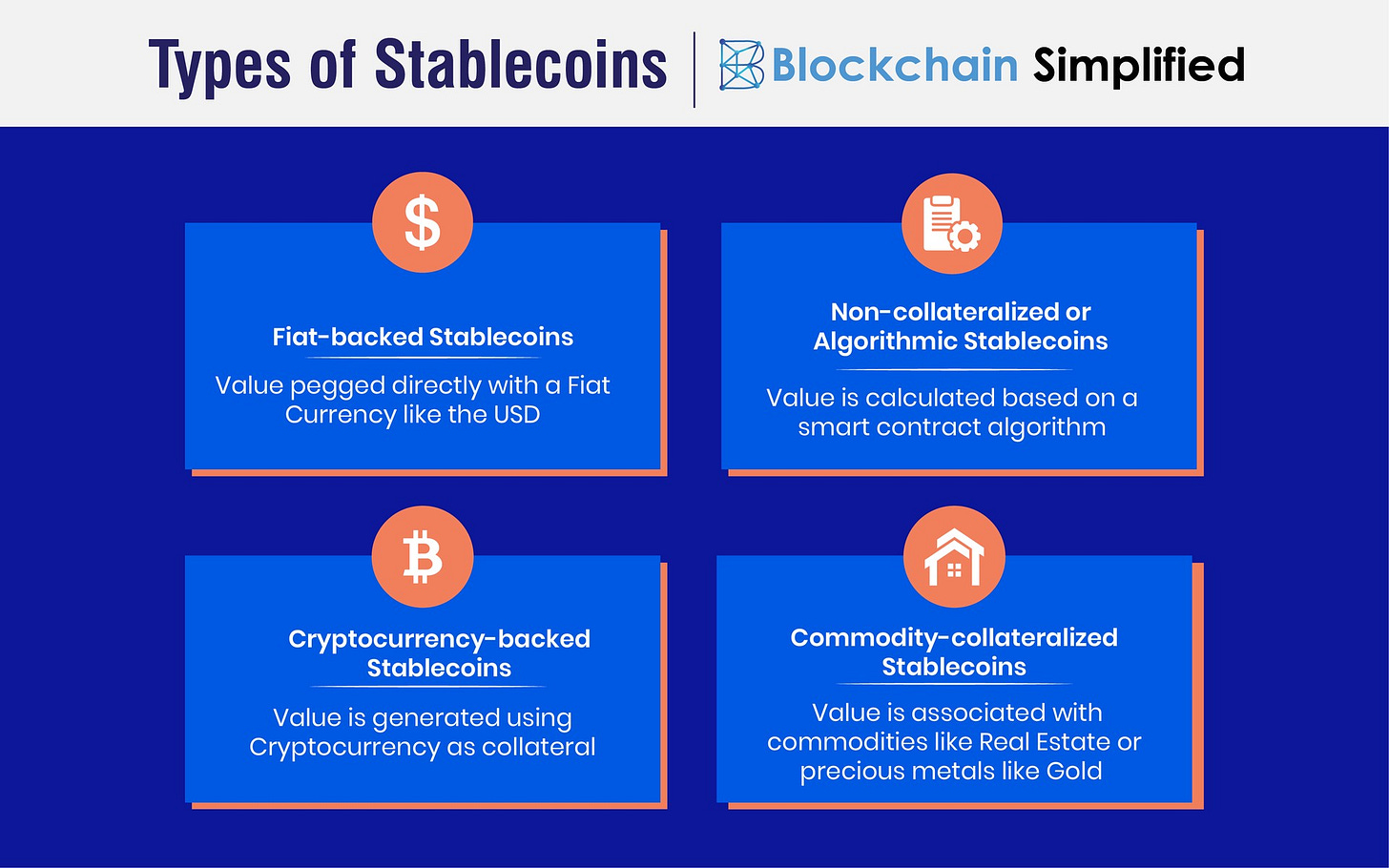

There are usually 4 main ways that stablecoins maintain peg:

Fiat-backed Stablecoins (USDC, USDT)

Commodity-backed Stablecoins (PUSD)

Cryptocurrency-backed Stablecoins (MIM, DAI)

Algorithmic Stablecoins (UST, USDN)

That was a lot to take in…. So I’ll give a very brief explanation of how they each work.

Fiat-backed stablecoins are the simplest. Every token of USDC and USDT is backed by physical reserves of cash, held in a treasury in the real world. If you sell 1 USDC/USDT on an exchange for 1 USD, the token will be burnt and 1 dollar would be withdrawn from the treasury. However, there are issues regarding the lack of transparency and centralized nature of this.

For example: Tether has failed to produce an audit proving that they hold the necessary cash in their treasury to back their USDT tokens.

Commodity-backed stablecoins work very much in the same way. Instead of holding a cash reserve in their treasury, the issuers of the stablecoin hold real world assets instead. This can be in the form of many things such as real estate, however, the most common is gold.

If you wanted to withdraw PUSD, you could either sell it for a fiat backed stablecoin, or withdraw and own the physical gold representation of it.

These following coins aim to achieve peg via a more decentralised nature:

Crypto-currency backed stablecoins use the same mechanism as the two types mentioned above. Due to the volatile nature of the industry however, the token must be backed via a system of debt obligations.

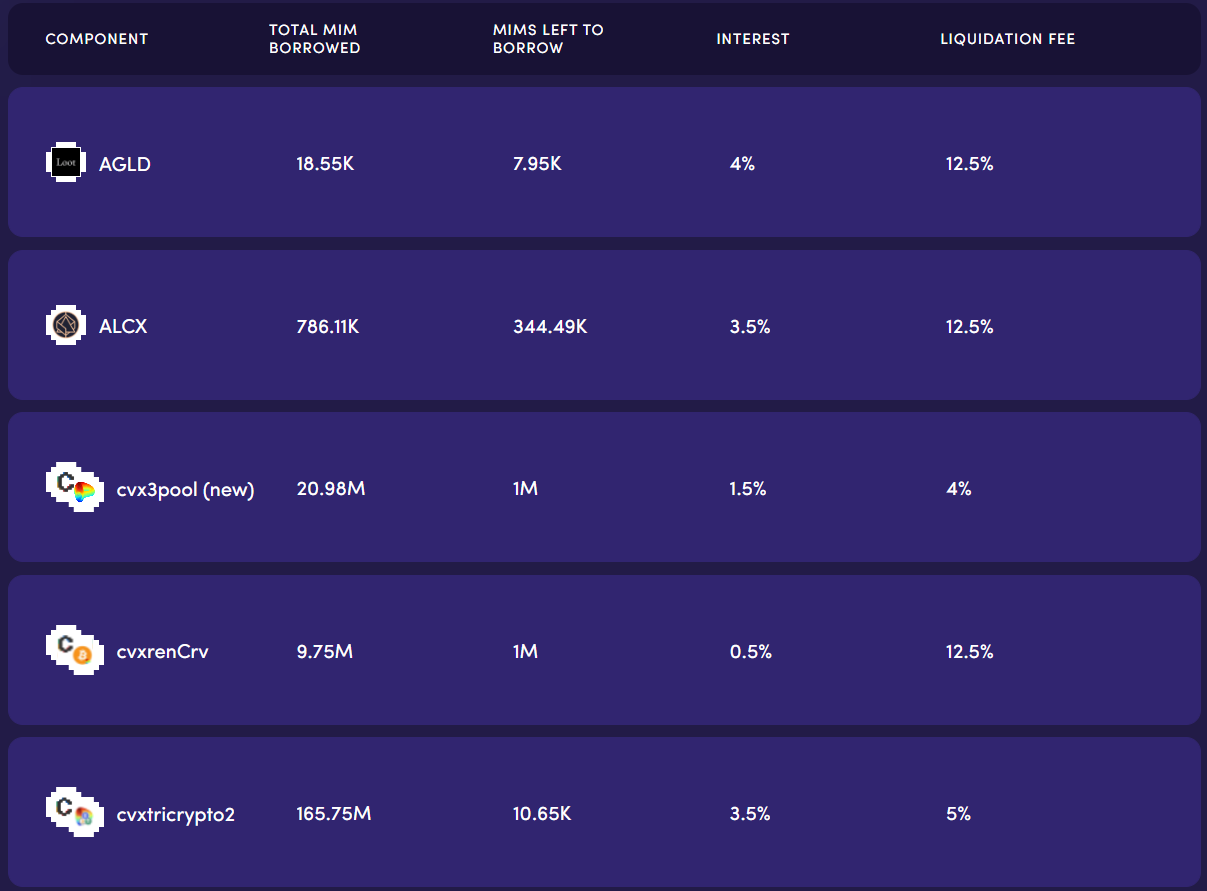

For example: A user can borrow MIM against their cryptocurrency tokens with a maximum LTV of 90% - this means a user is able to borrow MIM up to 90% of the value of their underlying token. If ever the LTV goes below 90% (ie in the even that the token price decreases), the user’s collateral will be liquidated on the open market, and they will be able to keep the MIM that they borrowed. However, there will be no way to recover their collateral.

Below you can see some of the assets that is supported by the abracadabra.money protocol. The beauty of this protocol is that it allows users to borrow against interest bearing tokens, which I will discuss in the next issue.

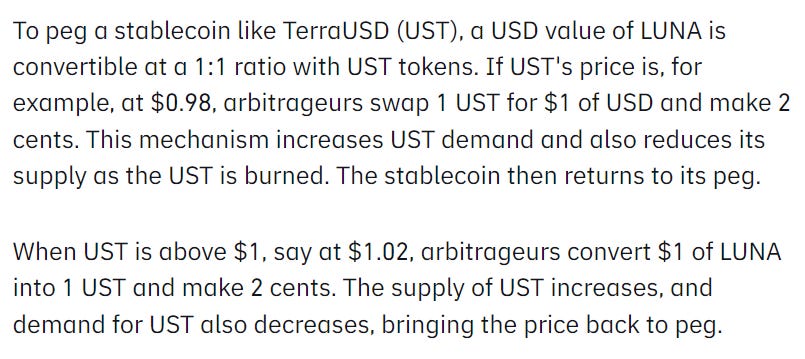

Finally, algorithmic stablecoins have a different approach to maintaining peg. With UST for example, it maintains its peg via senoriage, and its relation to LUNA. The below is an extract from the binance academy article on LUNA which can be found here: https://academy.binance.com/en/articles/what-is-terra-luna

By using an algorithm like the one mentioned above, UST is able to achieve a peg to the US dollar, whilst remaining extremely decentralised and still having a layer of protection against large centralised entities such as governments.

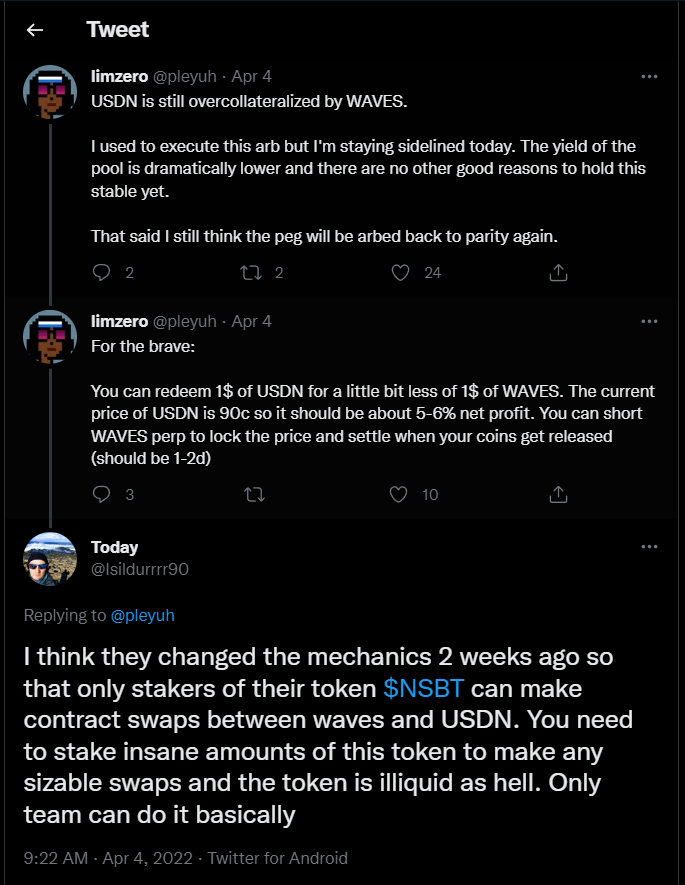

However, many of these algorithmic stablecoins suffer from setbacks. For example, the USDN stablecoin which is partially collateralised by WAVES has recently lost peg, and still has not regained the price of $1. A small thread on the failure of USDN can be seen below:

If stablecoins are still confusing then here’s some supplementary articles that explain them in more detail/in a more user friendly way:

https://www.gemini.com/cryptopedia/what-are-stablecoins-how-do-they-work#section-medium-of-exchange-and-store-of-value

https://www.gemini.com/cryptopedia/magic-internet-money-mim-crypto-abracadabra-money#section-mim-crypto-minting-fees-and-risks-explained

https://angelprotocol.medium.com/how-does-ust-work-ec7b2f6e2c2c

I believe that I’ve given a detailed overview of stablecoins. Feel free to contact me on discord at Fast2.0#5364 if you think I’ve missed anything or if there’s anything that I should have included in this article!

With all that out of the way, let’s move onto DeFi Of The Week!

This week, I’ll be talking about the Curve protocol:

Curve documentation: https://resources.curve.fi/

Curve is a multichain exchange designed solely for the transaction of stablecoins. If you wanted to exchange $100 worth of USDC for USDT, Curve would likely give you the exchange rate with the lowest slippage. There’s innovative protocols such as Platypus on AVAX that may give better rates, but they’re not multi-chain or have stood the test of time like Curve.

Now you might be asking - why is this needed?

After all, shouldn’t every stablecoin maintain the same price of $1?

Unfortunately, this is not the case in the real world. As you can see from USDN example mentioned above, stablecoins can frequently fail, especially when new technology is used to attempt to maintain peg.

In addition to this, we need to have an exchange with deep liquidity, so that when you exchange large amounts of a stablecoin for another, say 1,000,000 USDT for DAI, you won’t end up with 900,000 DAI (slippage and loss of 10%).

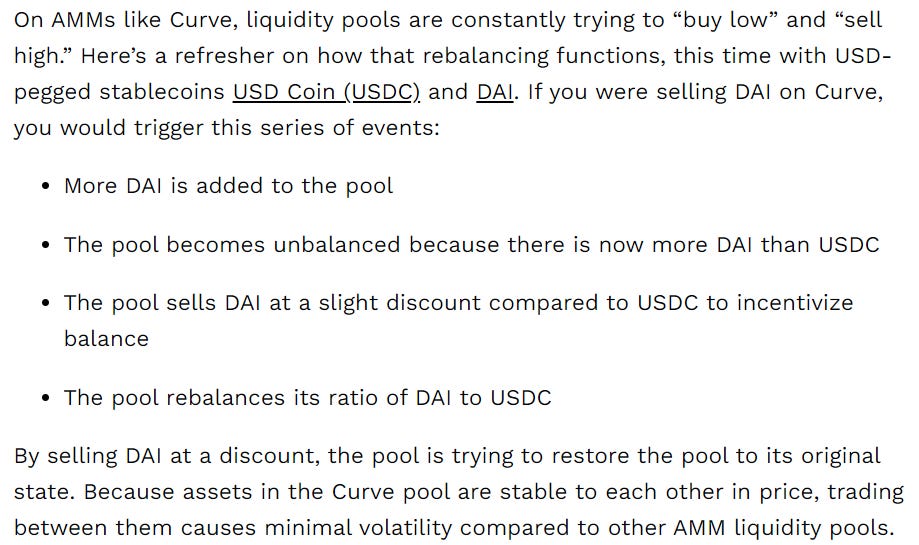

Curve attempts to maintain stability in the stablecoin ecosystem via incentivising liquidity on their platform. What this means is that users can deposit stablecoins, and in return receive interest paid out in the form of the Curve token. These are the “liquidity providers” of the protocol, and their deposits allow Curve to maintain low slippage exchange rates. Below is an extract from Gemini exchange which explains how Curve’s Automated Market Makers (AMMs) work:

Arbitrageurs will be able to capitalise on the discounted DAI, helping to balance out the pool and maintain stability.

If you’re still confused to as how AMMs work - Don’t worry! Here are some videos that explain the process in a more user friendly manner:

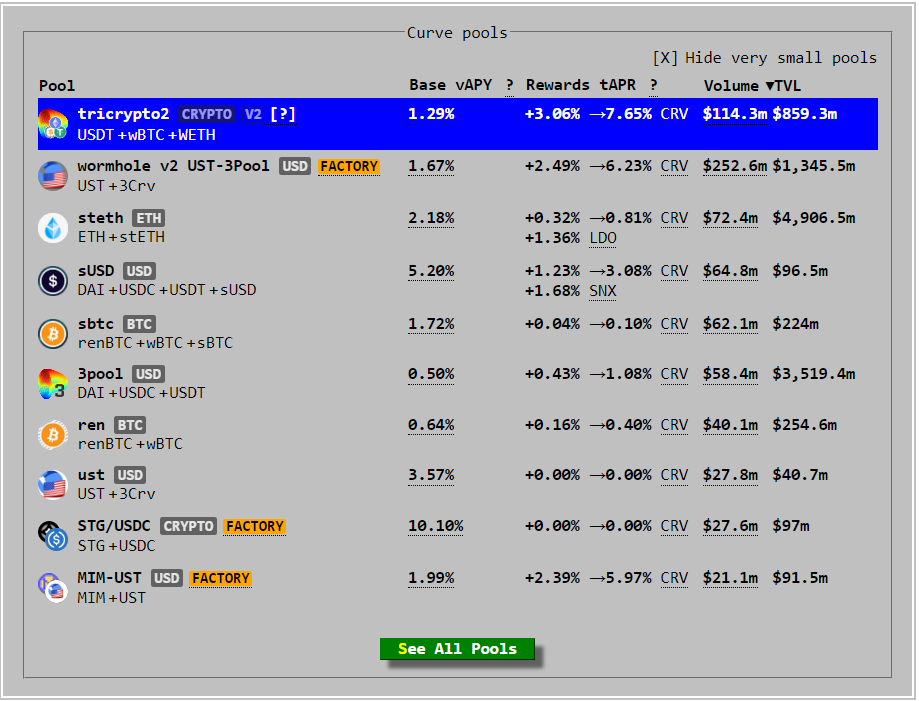

Now that we’ve explained how Curve allows for exchange of stablecoins via liquidity pools, let’s talk about the $CRV token itself which as stated before, is given to LPs as a form of reward. Below is an image showing the pools and interests supported by Curve.

As you can see, there are two columns. Base APY is the APY rewarded from trading fees in the form of whatever pool token is supplied. For example, if I provided liquidity in the 3pool (DAI + USDC + USDT) I would earn 0.5% interest split between DAI, USDC and USDT. However, since the base vAPY is based off trading fees, it frequently changes and is dependent on the volume that pool experiences.

The second column, Rewards tAPY is the APY earned in the form of the $CRV token. As you can see, there is a range for the rewards. This is because users can lock up their CRV tokens to receive veCRV anywhere from 1-4 years to “boost” rewards, up to a maximum of 2.5x multiplier. In addition to this, users who lock their tokens receive governance votes on emissions of the CRV token similar to AAVE.

This ability for users to control incentives for liquidity means that governance votes for emissions are a key part of the value in the CRV token. There’s a whole ecosystem that aims to take advantage of this voting mechanism including other protocols such as Convex and BENT. However, I won’t go into detail about that in this article, as it’s vastly complicated.

Finally, I’ll finish this issue with some news of the week and some interesting threads:

USDN depegs - https://coinmarketcap.com/currencies/neutrino-usd/

A thread on the macro environment experienced by the new generation:

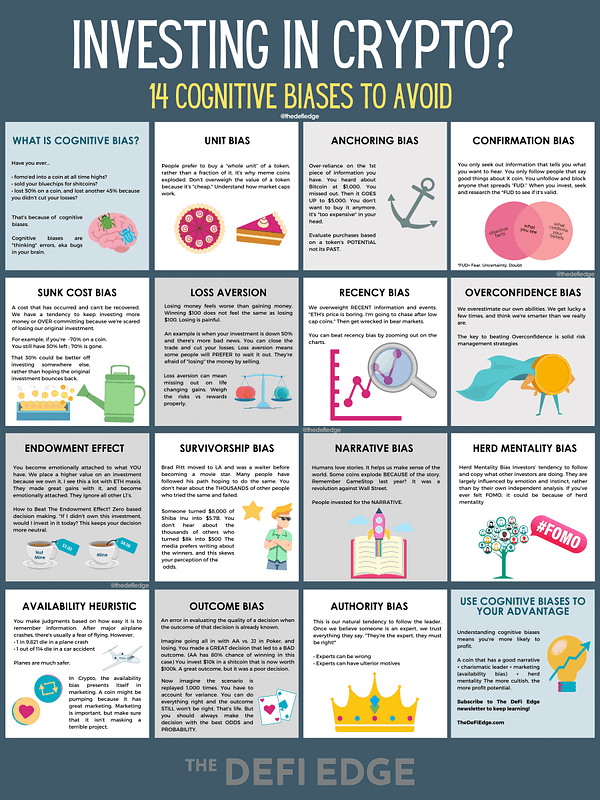

Cognitive biases in decision making:

If you’re still here, I’m considering publishing an issue every month rather than every other week. These articles take a lot of research and effort, and unfortunately I’m just one person writing them. I want to write quality content instead of rushing to finish these articles.

The next article will be about Anchor Protocol on LUNA, how it attempts to provide the highest possible stablecoin interest rate, and an explanation of how interest bearing (ibTokens) work.